Get a Complete Understanding on the Canadian Cannabis Regulation, The Mandate Behind Regulations & How They’ve Helped Grow the Canadian Economy through the New Cannabis Industry

Today, we dive into the fascinating world of cannabis farming in Canada, exploring the game-changing legislation known as the Cannabis Act. This groundbreaking legislation has not only revolutionized the way cannabis is cultivated and consumed in Canada, but it has also opened up a world of possibilities for both seasoned farmers and aspiring ganja-growers.

Now, you may be wondering: what does this mean for cannabis farming in Canada? Well, my friends, it meant that the possibilities are endless. With the Cannabis Act in place, farmers across the country were able to legally cultivate and sell cannabis on a commercial scale. This has opened up a whole new world of opportunities for those with a passion for cannabis cultivation, from small-scale boutique operations to large-scale commercial enterprises.

So, whether you’re a seasoned farmer looking to diversify your crop or an aspiring green thumb eager to jump into the world of cannabis farming, this blog is for you.

What Led to the Cannabis Act Being Implemented?

The Task Force on Cannabis Legalization and Regulation was established shortly after Justin Trudeau became prime minister in 2015. Recognizing the need for a comprehensive framework to regulate the production, distribution, and consumption of cannabis, the Canadian government formed this task force to gather input from experts, stakeholders, and the public.

The task force was composed of individuals with diverse backgrounds, including law enforcement, public health, and industry professionals. Their mandate was to engage in extensive consultations and provide recommendations on the design of a new regulatory framework for cannabis.

Background Information on The Task Force on Cannabis Legalization and Regulation

With the aim of ensuring public health and safety while also addressing the concerns of legalization advocates, the task force conducted consultations across the country. They sought input from a wide range of stakeholders, including health professionals, law enforcement agencies, Indigenous groups, youth organizations, and even everyday Canadians.

After months of research, analysis, and public engagement, the task force presented its recommendations to the government. Their report served as a crucial foundation for the development of the Cannabis Act, which aimed to establish a strict legal framework for controlling the production, distribution, sale, and possession of cannabis in Canada.

Announcing the Cannabis Act

The Liberal government, determined to fulfill their campaign promise of legalizing cannabis, intended to table legislation based on the task force’s recommendations by April 13. This timing was strategic as it fell just ahead of the 420 holiday on April 20th, a significant date for cannabis enthusiasts worldwide.

However, the actual legalization date was set to June 19, 2018. This decision was made to avoid setting the date on Canada Day, which is celebrated on July 1st. By scheduling the legalization date for June 19th, the government aimed to separate the celebration of cannabis legalization from the festivities of Canada’s national holiday. In the next section, we’ll dive into the cannabis act, and how it actually regulates the production and consumption of cannabis in Canada.

Related Reading

What Does the Cannabis Act Cover?

The Cannabis Act was introduced with the aim of creating a legal framework for the control and regulation of cannabis in order to protect public health and safety, keep cannabis out of the hands of young people, and reduce the illicit market.

Let’s dive into each of these components of the act and understand what constitutes legal activity under it.

Production

The Cannabis Act establishes a licensing framework for the cultivation, propagation, and harvesting of cannabis. It sets out strict requirements for security measures, record-keeping, quality control, and product tracking. Licensed producers are responsible for compliance with these regulations and are subject to inspection and enforcement.

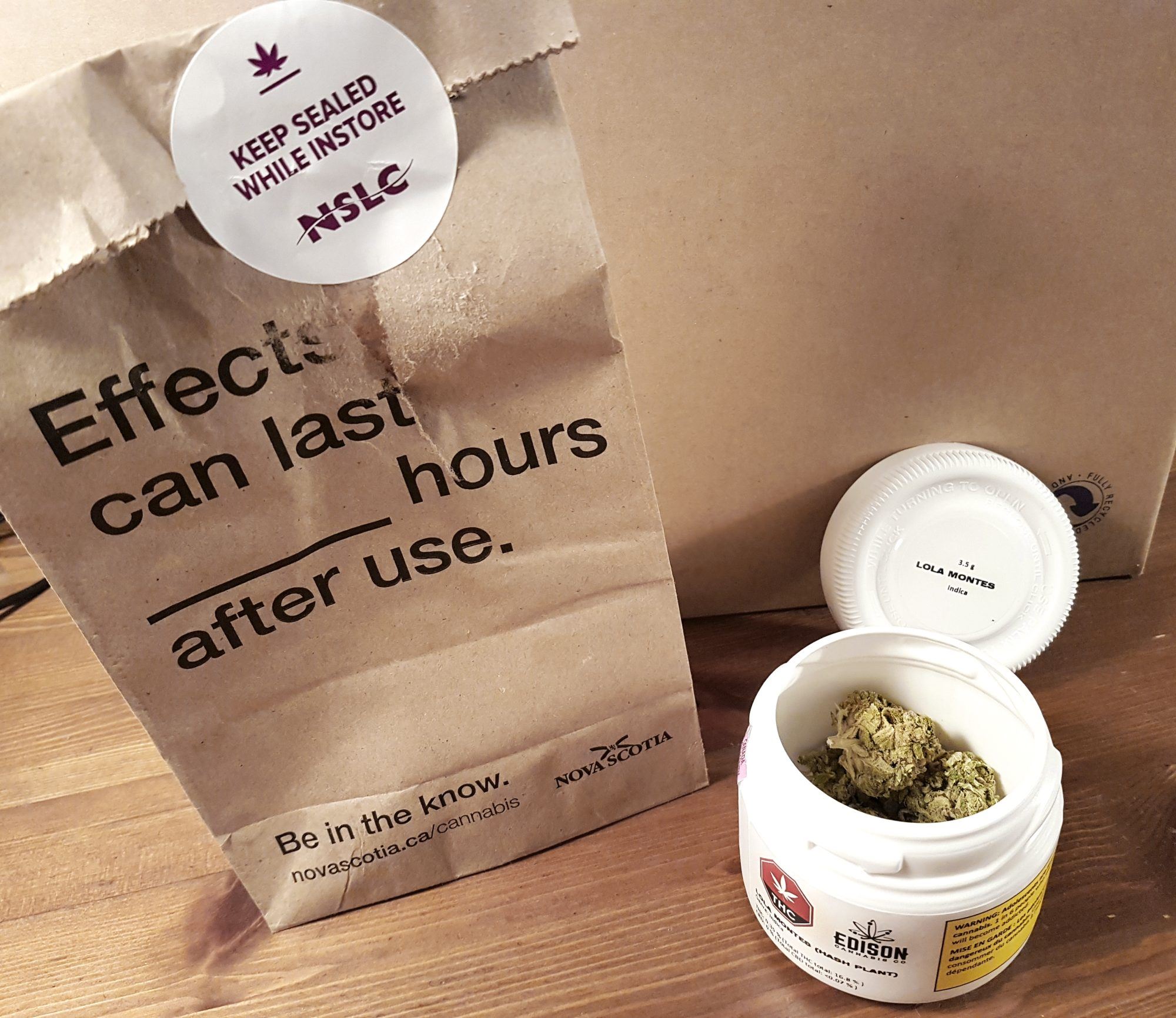

Packaging and Labelling

The act mandates specific packaging and labelling requirements to ensure that consumers have access to information related to the product they are purchasing. Packaging must be child-resistant and plain, with strict restrictions on logos, branding, and colors. Labelling must include information such as the cannabis product’s potency, strain name, health warnings, and the producer’s information.

Import and Export

The Cannabis Act provides for a licensing system to regulate the import and export of cannabis and cannabis products. Licensed individuals and companies can import and/or export cannabis for medical, scientific, or commercial purposes. Strict oversight and record-keeping are in place to prevent diversion and ensure compliance with international obligations.

Marketing and Promotion

The act imposes strict restrictions on the marketing and promotion of cannabis products to prevent their appeal to young people and discourage consumption. Promotion is limited to factual information about the product, and advertising in places where youth may be exposed is prohibited. Health warnings must accompany any promotional material.

Medical Use

The Cannabis Act allows for the medical use of cannabis and establishes a framework for its access. Health Canada oversees the registration and licensing of individuals and organizations involved in the production, distribution, and sale of cannabis for medical purposes. Patients can access cannabis through licensed producers or grow their own supply after obtaining a registration certificate.

In order for an activity to be considered legal under the Cannabis Act, it must align with the regulations outlined for each component. This means that individuals or companies must obtain the necessary licenses and permits, adhere to security and quality control measures, comply with packaging and labelling requirements, and ensure that any marketing or promotion is in line with the restrictions set out by the act.

The Cannabis Act represented a significant shift in Canada’s approach to cannabis, moving from a prohibitionist model to a regulated market. By establishing a clear and comprehensive framework, it aims to balance public health and safety concerns with individual rights and access to cannabis for medical purposes.

Next up, we’ll briefly discuss the local provincial, and territorial cannabis related legislations.

Provincial & Territorial Cannabis Legislations

Cannabis legislation in Canada has undergone significant changes in recent years with the introduction of the Cannabis Act in 2018. This federal law legalized the production, sale, and consumption of cannabis for recreational purposes. However, each province and territory still has the authority to establish its own regulations within the framework set by the federal government. Let’s explore the cannabis legislations in the various Canadian provinces and territories.

Alberta

Alberta has adopted a private retail model for cannabis sales. The Alberta Gaming, Liquor and Cannabis Commission (AGLC) is responsible for regulating the distribution and sale of cannabis in the province. Adults aged 18 and above are allowed to possess and purchase cannabis.

British Columbia

British Columbia has also implemented a private retail model for cannabis sales. The Liquor Distribution Branch (LDB) operates public retail stores, while private retailers are also permitted. The legal age for purchasing and possessing cannabis is 19.

Manitoba

Manitoba has established a hybrid model for cannabis sales, with both public and private retail options available. The Liquor, Gaming, and Cannabis Authority of Manitoba (LGCA) regulates the distribution and sale of cannabis. The legal age for purchasing and possessing cannabis is 19.

New Brunswick

New Brunswick has opted for a government-operated retail model, with the New Brunswick Liquor Corporation (NBLC) overseeing the distribution and sale of cannabis. The legal age for purchasing and possessing cannabis is 19.

Newfoundland and Labrador

Newfoundland and Labrador has chosen a private retail model for cannabis sales. The Newfoundland and Labrador Liquor Corporation (NLC) regulates the distribution and sale of cannabis. The legal age for purchasing and possessing cannabis is 19.

Northwest Territories

The Northwest Territories has implemented a hybrid model for cannabis sales, with the Northwest Territories Liquor and Cannabis Commission (NTLCC) overseeing the distribution and sale of cannabis. Both public and private retail options are available. The legal age for purchasing and possessing cannabis is 19.

Nova Scotia

Nova Scotia has adopted a government-operated retail model, with the Nova Scotia Liquor Corporation (NSLC) responsible for the distribution and sale of cannabis. The legal age for purchasing and possessing cannabis is 19.

Nunavut has opted for a government-operated retail model, with the Nunavut Liquor and Cannabis Commission (NULC) overseeing the distribution and sale of cannabis. The legal age for purchasing and possessing cannabis is 19.

Ontario

Ontario has recently transitioned to a private retail model for cannabis sales, with the Alcohol and Gaming Commission of Ontario (AGCO) regulating the distribution and sale of cannabis. The legal age for purchasing and possessing cannabis is 19.

Prince Edward Island

Prince Edward Island has chosen a government-operated retail model, with the Prince Edward Island Liquor Control Commission (PEILCC) overseeing the distribution and sale of cannabis. The legal age for purchasing and possessing cannabis is 19.

Quebec

Quebec has implemented a government-operated retail model, with the Société québécoise du cannabis (SQDC) responsible for the distribution and sale of cannabis. The legal age for purchasing and possessing cannabis is 21.

Saskatchewan

Saskatchewan has adopted a private retail model for cannabis sales. The Saskatchewan Liquor and Gaming Authority (SLGA) regulates the distribution and sale of cannabis. The legal age for purchasing and possessing cannabis is 19.

Yukon

Yukon has implemented a hybrid model for cannabis sales, with both government-operated and private retail options available. The Yukon Liquor Corporation (YLC) oversees the distribution and sale of cannabis. The legal age for purchasing and possessing cannabis is 19.

It is important to note that while the Cannabis Act provides a framework for the legalization of cannabis across Canada, each province and territory has its own specific regulations and requirements. This allows for flexibility in tailoring the legislation to the unique needs and preferences of each region. The information provided here serves as a general overview, and it is advisable to consult the specific provincial or territorial legislation for detailed information.

Pro-Tip for Cannabis Producers

Canadian seed-to-sale cannabis software plays a crucial role in the efficient and effective tracking and licensing of cannabis cultivation and sales. With the implementation of the Cannabis Act in Canada, it has become essential for cannabis businesses to comply with strict regulations and reporting requirements. Seed-to-sale cannabis software facilitates the entire process, from initial applications for licenses to amendments, license renewals, and the submission of monthly tracking reports.

By utilizing this software, cannabis businesses can ensure accurate and timely compliance with the Cannabis Act, which is essential for maintaining their licenses and operating legally. The software enables businesses to track and manage their cannabis inventory, ensuring that all plants and products can be accounted for from seed to sale. It also helps with maintaining detailed records of all activities and transactions, providing a transparent and auditable system that meets regulatory requirements.

Did you know? GrowerIQ has an industry-leading Seed-to-Sale Cannabis Software (with quality management built in) that is designed to uncomplicate cannabis production for cannabis producers throughout the world.

Related Reading

- Cannabis Courses

- List Of Licensed Producers In Canada

- Cannabis Manufacturing

- Cannabis Licensing Application Guide

How Much Tax Revenue does Legalized Cannabis Generate for the Canadian Government

The Canadian government has reaped substantial financial benefits from the sale of cannabis in the 2021-2022 fiscal year. When considering all the taxes at the provincial and federal levels, the government was able to earn a staggering CA$ 1.6 billion.

Provincial Tax Contribution

A significant portion of this revenue, CA$300 million to be exact, comes from the net income generated by province-owned liquor and cannabis authorities. These authorities have effectively managed the distribution and sale of cannabis products, ensuring a steady flow of income for the government.

Excise Taxes

Additionally, the government collected CA$1.3 billion from various taxes and other sources of revenue. This amount can be further broken down into different categories. Firstly, CA$200 million was generated through federal excise tax. This tax is imposed on licensed cannabis producers based on the quantity of cannabis they sell.

The provincial excise taxes and other provincial or territorial revenue contributed CA$600 million to the total revenue. These taxes are levied by the respective provinces or territories on the sale of cannabis within their jurisdictions. Each province has its own specific tax rates and regulations, allowing them to generate revenue tailored to their needs.

Cannabis Retail Sales Taxes

Finally, retail sales taxes accounted for CA$500 million of the overall revenue. These taxes are applied to the final purchase price of cannabis products and are collected by the retailers at the point of sale. This revenue stream serves as a significant source of income for the government.

By carefully implementing the Cannabis Act and establishing a well-regulated market, the Canadian government has been able to generate substantial revenue from the sale of cannabis. The combination of federal excise tax, provincial excise taxes, and retail sales taxes has proven to be a successful model for generating income for the government. Additionally, the efficient operations of province-owned liquor and cannabis authorities have played a crucial role in contributing to the overall revenue.

Canadian Tax Revenue Broken Down by Cannabis Product Segment

The Canadian cannabis market has seen significant growth and evolution since the implementation of the Cannabis Act. As the industry continues to mature, it is crucial to understand the breakdown of duties and taxes associated with cannabis product sales in Canada. This knowledge helps us grasp the financial impact of different product segments and their contribution to tax revenue.

Cannabis Flower Generates the Most Tax Revenue

When it comes to duty assessed by the federal government, dried and fresh cannabis takes the lead, accounting for a substantial 79.2% of the total. This product segment has been the cornerstone of the cannabis industry, capturing the attention and demand of consumers across the country. The duty assessed on dried and fresh cannabis reflects its prominence in the market and its popularity among Canadian cannabis users.

Cannabis Extracts is the Runner-Up

Cannabis extracts, including oil, contribute to approximately 16.5% of the total duty assessed. This segment has gained momentum in recent years, with consumers recognizing the benefits and versatility of cannabis extracts. As more people explore alternative consumption methods, such as vaping and tinctures, the demand for extracts continues to grow. Consequently, the taxes collected from this product segment have become a significant source of revenue for the government.

Cannabis Edibles Are a Growing Product Category

The duty applied to cannabis edibles started to expand meaningfully in the 2019-20 financial year when these products were introduced nationwide. As a result, the total duty assessed on edibles increased from CA$1.2 million in 2019-20 to approximately CA$6.5 million in 2020-21. This growth demonstrates the rising popularity of cannabis-infused food and beverages among Canadian consumers. With an expanding variety of edibles available on the market, the government is generating increasing tax revenue from this segment.

Finally, during the 2020-21 fiscal year, duty assessed on topical cannabis products amounted to CA$973,000. These products, including creams, lotions, and balms, have gained traction as consumers explore the potential therapeutic benefits of cannabis-infused topical applications. While the contribution of topicals to tax revenue may be smaller compared to other segments, it signifies a growing interest in alternative forms of cannabis consumption.

Understanding the breakdown of duties and taxes associated with different cannabis product segments is crucial for assessing the financial landscape of the industry. Dried and fresh cannabis, extracts, edibles, and topicals each play a unique role in shaping the market and contributing to tax revenue.

What Effect Has the Cannabis Act Had on the Canadian Economy?

The cannabis industry has undeniably played a pivotal role in the growth of the Canadian economy since the legalization of cannabis in 2018. The numbers speak for themselves, according to a report created by Deloitte, the industry generated a staggering $11 billion in sales nationwide and making $29 billion in capital expenditures. This remarkable growth can be attributed to the industry’s substantial demands on the construction sector, as production facilities were built across the country.

Canadian GDP Grows Thanks to the Cannabis Act

The impact of the cannabis industry on Canada’s GDP has been truly significant, contributing $43.5 billion since legalization. Furthermore, Ontario, one of the key players in the industry, has seen a boost of $13.3 billion to its GDP. This influx of economic activity has translated into tangible benefits for the Canadian people, including the creation of 151,000 jobs and a substantial injection of $15.1 billion into government coffers. In Ontario alone, over 48,000 jobs have been created since legalization.

Reasons Behind the Economic Success

The economic success of the cannabis industry can be attributed to several factors. Firstly, the demand for cannabis and cannabis-related products has been steadily increasing, both domestically and internationally. This has led to a surge in sales, supporting the growth of existing businesses and the emergence of new players in the market. The Canadian cannabis industry has also benefited from favorable regulatory conditions, such as the Cannabis Act, which has created a robust framework for the legal production, distribution, and consumption of cannabis.

Spurring Growth in Supporting Industries

The economic impact of the cannabis industry extends beyond direct sales and job creation. It has also spurred growth in related sectors, such as agriculture, transportation, retail, and tourism. The cultivation and production of cannabis require specialized expertise, leading to the creation of jobs in various ancillary industries. Additionally, the legalization of cannabis has attracted tourists from around the world, generating revenue and stimulating local economies.

Looking ahead, the cannabis industry in Canada shows no signs of slowing down. As the industry continues to mature, we can expect further economic growth and job creation. Moreover, ongoing research and development in the sector hold the promise of innovative cannabis-based products, which could drive additional economic opportunities.

Related Reading

- Growing Cannabis Indoor

- Wholesale Cannabis

- Cannabis Packaging

- Cannabis Podcast

- Cannabis Packaging Canada

- Micro Cultivation Building Requirements

How Have Cannabis Producers Grown Since the Cannabis Act?

Cannabis farming in Canada has experienced significant growth since the Cannabis Act was enacted. With capital expenditures reaching a staggering $29 billion CAD, cannabis producers have been investing heavily in infrastructure, technology, and cultivation practices to meet the rising demand for cannabis products. This level of investment showcases the industry’s determination to thrive in the newly legalized market.

Job Creation

Moreover, the cannabis industry in Canada has also been a major contributor to job creation. As per the latest data available, it has directly created approximately 98,000 jobs across various sectors of the value chain, including cultivation, processing, distribution, and retail. These jobs have provided opportunities for Canadians in both urban and rural areas, further strengthening the economy and benefiting local communities.

Fragmented Market Shows Room for New Entrants

Despite the dominance of established cannabis producers, the Canadian cannabis producer market remains highly fragmented and competitive. In 2020, the top 9 cannabis producers accounted for nearly 80% of the market share. However, in 2021, this figure dropped to a combined 62%. This shift signifies the emergence of new players and a more diverse market landscape.

The decrease in market share among the top producers indicates that there is ample room for new entrants in the growing cannabis producer market in Canada. This presents an exciting opportunity for entrepreneurs, cultivators, and investors interested in venturing into the cannabis industry. By leveraging innovative cultivation techniques, branding strategies, and market segmentation, new players can establish themselves and compete effectively in this dynamic market.

How Seed To Sale Cannabis Software Helps Cannabis Producers

GrowerIQ’s seed-to-sale cannabis software is an invaluable tool for Canadian Cannabis Producers, as it streamlines the process of complying with the regulations outlined in the Canadian Cannabis Act. This comprehensive software platform effortlessly handles the complex tasks of production, packaging, labelling, import, and export, allowing producers to focus on their core business operations.

With GrowerIQ’s software, Canadian Cannabis Producers can easily track and monitor every stage of the production process, from seed to sale. This includes recording important data such as plant growth, cultivation techniques, the use of pesticides and fertilizers, to packaging and labelling requirements. By having access to this detailed information, producers can ensure that their operations are fully compliant with the regulations set forth by the Cannabis Act.

Discover how GrowerIQ’s seed-to-sale software can help you set up all of the components of a successful cannabis production operation without any hassle. Questions we haven’t covered? Please reach out and let us know. GrowerIQ serves clients coast to coast, and we’re ready to help your team today.

Streamline Cannabis CultivationAbout GrowerIQ

GrowerIQ is changing the way producers use software - transforming a regulatory requirement into a robust platform to learn, analyze, and improve performance.

To find out more about GrowerIQ and how we can help, fill out the form to the right, start a chat, or contact us.