Fuel your cannabis venture with Seed to Sale Funding. Learn to secure funds and turn your business plan into a growth story success.

Entrepreneurs and visionaries are seeking innovative ways to fund their ventures, and Seed to Sale Funding is emerging as a game-changer. This comprehensive approach allows you to control every step of the process, ensuring the highest quality products and maximized profitability. But how do you secure the necessary funds to embark on this journey? How do you navigate the complex landscape of Seed to Sale Funding and find the right investors who share your vision? Let’s dive deep into the world of Seed to Sale Funding, exploring its benefits, challenges, and strategies to help you turn your Cannabis Business Plan into a flourishing success story.

What is Seed to Sale Funding?

Seed to sale funding is a form of financing that provides crucial support to cannabis cultivators at all stages of their business journey. Whether they are just starting out or looking to expand, this type of financing offers a range of options to meet their specific needs. Let’s take a closer look at each type of funding and how it can benefit cannabis cultivators.

1. Real Estate Loans

Building a solid foundation for their business is essential for cannabis cultivators. With real estate loans, they can finance the construction, renovation, or build-out of their retail stores, cultivation facilities, greenhouses, and processing facilities. In addition, these loans can also be used for cash-outs and refinancing existing loans. Real estate loans typically start at $500,000, providing cultivators with the necessary capital to establish or upgrade their infrastructure.

2. Real Estate Sale Leasebacks

Cannabis cultivators can unlock the value of their real estate assets through sale leasebacks. By selling their property to investor-landlords while continuing to occupy the premises, cultivators can access significant amounts of funding. This funding, usually starting at $5,000,000, can be used to fuel further growth and expansion. The leaseback arrangement allows cultivators to maintain operational control while freeing up capital for other business needs.

3. Equipment Loans and Leases

Processors, extractors, and testing laboratories rely on specialized equipment to carry out their operations efficiently. Equipment loans and leases provide the necessary funding to purchase extraction lines, packaging and bottling equipment, and laboratory equipment. With financing starting at $100,000, cultivators can acquire the tools they need to enhance productivity and achieve higher levels of quality in their products.

4. Unsecured Business Loans

Sometimes, cultivators require funding for general business purposes, such as marketing campaigns, research and development, or hiring additional staff. Unsecured business loans offer the flexibility to allocate capital as needed, without requiring specific collateral. These loans, ranging from $100,000 to $1,000,000 or more, are approved based on the cash flows and margins of the business. This type of financing ensures cultivators have the necessary resources to adapt and grow in a rapidly evolving industry.

5. Working Capital Financing

Cash flow management is crucial for the success of any business, and cannabis cultivators are no exception. Working capital financing provides a lifeline to bridge short-term gaps in cash flow, enabling cultivators to meet their financial obligations and seize opportunities as they arise. Lenders assess the business’s revenues and profits over the last year to determine the loan amount, which can range from $100,000 to $5,000,000 or more. This type of funding ensures cultivators have the necessary liquidity to navigate the dynamic cannabis market.

What are Typical Eligibility Requirements for Seed to Sale Funding?

When seeking seed to sale funding for a cannabis business, there are several key documents that you will typically need to provide. These documents are crucial in demonstrating the viability and potential of your business to potential financiers. Here are the typical eligibility or qualifying documents required to secure seed to sale funding:

1. Business Information

The first set of documents required will include all relevant business information. This includes licensing information, such as permits and certifications needed to operate legally within the cannabis industry. It is important to provide comprehensive details about your current and projected revenue, showcasing your ability to generate profits and sustain growth. Financiers will want to review your balance sheet to assess your financial position and potential risks. It is also essential to provide detailed information about the owners, partners, and investors involved in your cannabis business. This helps establish credibility and highlights the experience and expertise of those leading the venture. Lastly, staffing details, such as the number of employees and their roles, are necessary to demonstrate the operational capacity of your business.

2. Adequate Credit Score

In some cases, financiers may require owners or directors of the cannabis business to have an adequate credit score. This is an important factor in determining the financial reliability and credibility of the individuals involved. A strong credit score indicates a history of responsible financial management and reduces the risk for potential investors. In certain situations, financiers may also request that the funding be personally guaranteed by senior management. This ensures that the individuals with a vested interest in the business are accountable and committed to its success, especially considering the ever-evolving legal landscape of the cannabis market.

3. Criminal Record Check

Due to the nature of the cannabis industry, owners may be required to undergo a criminal record check. This is particularly important in regions where cannabis business licenses are subject to strict regulations and background checks are mandatory. The purpose of this check is to ensure that individuals involved in the business have no criminal history that could pose a risk to the operation or the reputation of the industry. Clearing this check strengthens the trustworthiness of your business and enhances your chances of securing seed to sale funding.

Related Reading

Business KPIs that a Seed to Sale Funder Looks At

As cannabis cultivation and sales become legalized in more and more regions, entrepreneurs and cultivators are seeking financing to establish and expand their businesses. To secure seed to sale funding, it is essential for cannabis cultivators to provide financiers with key performance indicators (KPIs) that demonstrate the potential for profitability and success. These metrics offer valuable insights into the performance and viability of the business, allowing financiers to gauge the level of risk involved in providing financing. Let’s explore some of the key performance indicators that cannabis cultivators need to provide and how financiers use them to assess risk.

Volume Metrics

Volume metrics refer to the quantity of cannabis sold, expressed in kilograms (KGs). This includes the separate metrics for medicinal cannabis and recreational cannabis, as well as the total volume sold. Financiers use these metrics to assess the market demand and growth potential of the business. A higher volume of cannabis sold indicates a larger customer base and increased market share, reducing the risk for financiers. These metrics also help financiers understand the scalability of the business and its ability to meet market demand.

Pricing Metrics

Pricing metrics are crucial for understanding the revenue potential of a cannabis business. The average selling price of medicinal cannabis and recreational cannabis provides insights into the profitability of the products. Financiers analyze these metrics to evaluate the business’s pricing strategy and its ability to generate sufficient revenue. Higher average selling prices indicate premium products or a competitive advantage in the market, reducing the risk for financiers. Pricing metrics help financiers assess the business’s ability to maintain profitability even in the face of potential price fluctuations.

Revenue Metrics

Revenue metrics provide a comprehensive view of the business’s income streams. It includes the revenue generated from medicinal cannabis sales, recreational cannabis sales, wholesale cannabis sales, and retail cannabis sales. Financiers closely examine these metrics to evaluate the diversification of revenue sources and the business’s ability to generate consistent income. Higher revenue figures indicate a strong market presence and customer demand, reducing the risk for financiers. These metrics also help financiers assess the business’s ability to navigate regulatory changes and potential market fluctuations.

Gross Profit

Gross profit is a crucial metric that indicates the profitability of the business after accounting for the cost of goods sold (COGS). It is calculated by subtracting the COGS from the total revenue. Financiers use this metric to assess the business’s ability to generate profit from its core operations. A higher gross profit margin indicates efficient cost management and a competitive advantage in the market, reducing the risk for financiers. This metric also helps financiers evaluate the scalability and sustainability of the business model.

Net Profit

Net profit measures the overall profitability of the business after accounting for all expenses, including operating costs, taxes, and interest payments. It is calculated by subtracting the total expenses from the gross profit. Financiers consider this metric to assess the business’s financial health and its ability to generate sustainable profits. A higher net profit indicates strong financial management and a lower risk for financiers. This metric also helps financiers evaluate the business’s long-term growth potential and its ability to repay loans or generate returns on investments.

By providing these key performance indicators to financiers, cannabis cultivators can demonstrate their business’s potential for success and secure the seed to sale funding they need. These metrics allow financiers to assess the level of risk involved and make informed decisions about financing. These metrics provide valuable insights into the business’s market position, profitability, and scalability, enabling both cultivators and financiers to align their interests and work toward mutual success.

What Factors Affect Seed to Sale Funding Success

Value and Availability of Collateral

Securing a loan for a cannabis business often requires pledging real estate as collateral. The value of this real estate and the equity available to pledge will play a significant role in determining the loan amount. Lenders will assess the market value of the property and the potential for appreciation. The higher the value and equity, the more favorable the loan terms will be.

Business History and Ability to Repay

Demonstrating a track record of profitable operations is crucial when applying for seed to sale funding. Lenders want to see that your cannabis business has been consistently generating revenue and can sustain its operations. Providing financial statements, including cash flow projections and profit and loss statements, will help lenders assess your ability to repay the loan. Ideally, you should have at least two years of profitable operation to increase your chances of approval.

Compliance Violations, Tax Issues, and Bankruptcies

Maintaining a clean compliance record is essential in the cannabis industry. Any past compliance violations, such as license revocations or suspensions, can raise red flags for lenders and make it challenging to secure funding. Similarly, tax issues, such as unpaid taxes or tax liens, can negatively impact the loan application process. Bankruptcies, especially recent ones, can also hinder your ability to borrow. It is crucial to resolve any compliance issues, address tax liabilities, and demonstrate financial stability to improve your chances of obtaining funding.

Industry Knowledge and Expertise

Lenders will evaluate your understanding of the cannabis industry and your ability to navigate its unique challenges. Demonstrating expertise in cultivation, processing, distribution, or retail operations will strengthen your loan application. Providing a well-researched business plan that outlines your market analysis, competitive advantage, and growth strategies will instill confidence in lenders regarding your ability to succeed in the cannabis industry.

Relationships with Regulators and Investors

Building strong relationships with regulators and investors can positively impact your funding application. Having a good rapport with regulators demonstrates your commitment to compliance and can alleviate concerns about potential legal issues. Having reputable investors or partners can enhance your credibility and increase the likelihood of securing funding.

Market Potential and Growth

Lenders will assess the market potential and growth prospects of your cannabis business. They want to see that your business has a viable and sustainable market demand. Providing market research, competitor analysis, and a clear marketing strategy will help lenders understand the growth potential of your business and its ability to generate consistent revenue.

Risk Mitigation and Contingency Plans

Demonstrating a comprehensive risk management strategy is crucial for securing funding. Lenders want to see that you have identified potential risks and have contingency plans in place to mitigate them. This includes addressing risks related to regulatory changes, market fluctuations, competition, and supply chain disruptions. Clearly outlining your risk mitigation strategies will give lenders confidence in your ability to navigate challenges and repay the loan.

Related Reading

- Seed To Sale Crm

- Cannabis Business Consultants

- Cannabis Cultivation Business Plan

- Cannabis Dispensary Business Plan

- Cultivation Sop Template

- Cannabis Licensing Consultant

- Cannabis Venture Capital

- Grants For Cannabis Business

Pro Tip for Cannabis Business Owners

Maintaining compliance is a critical aspect of running a cannabis business, as the industry is highly regulated and subject to strict guidelines. GrowerIQ’s seed to sale software plays a crucial role in helping cannabis business owners maintain compliance by tracking the movement of cannabis from seed to sale with meticulous detail and full reporting capabilities.

Did you know? GrowerIQ has an industry-leading Seed-to-Sale Cannabis Software (with quality management built in) that is designed to uncomplicate cannabis production for cannabis producers throughout the world.

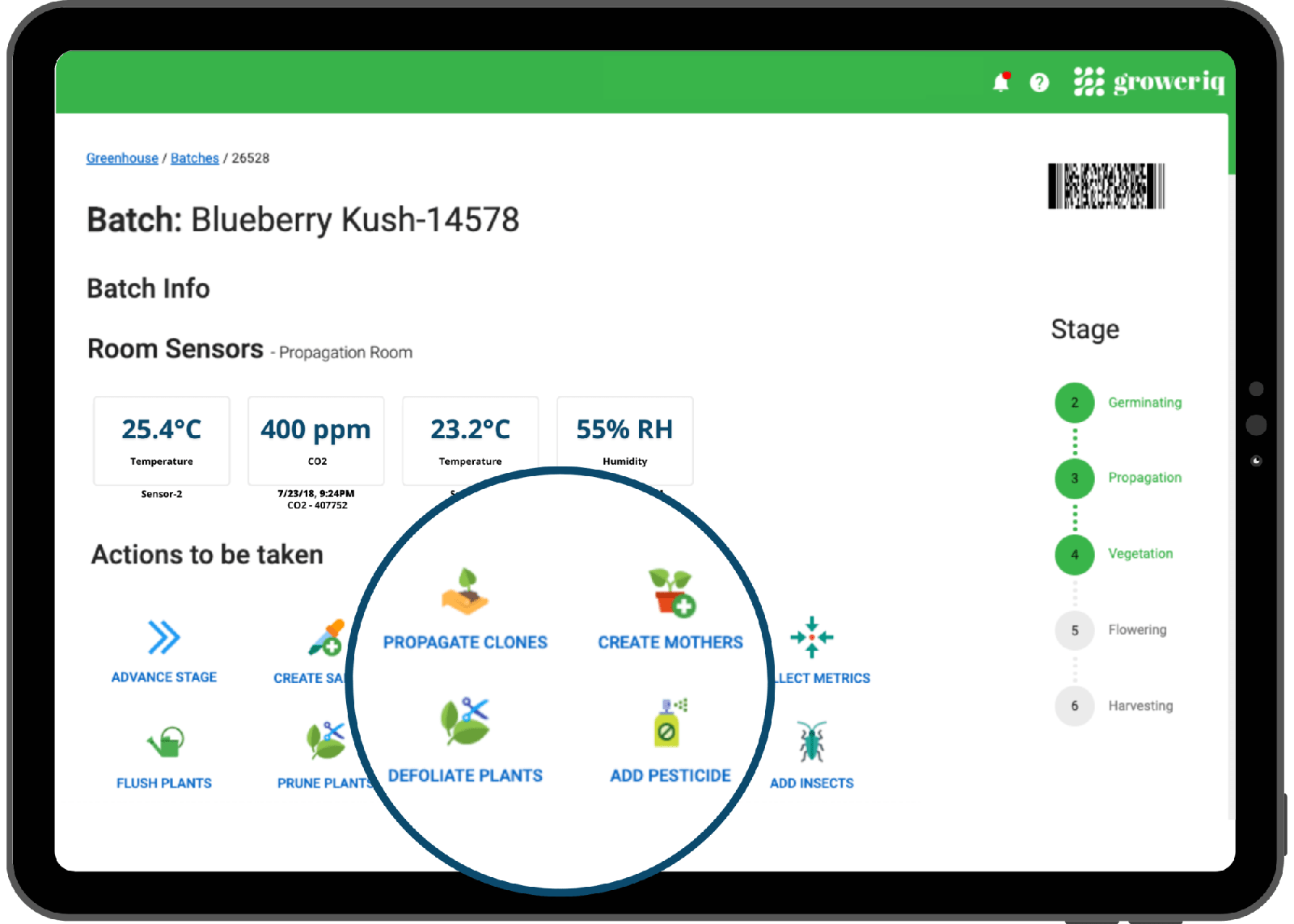

Cultivation Tracking with GrowerIQ

The software enables business owners to track the entire lifecycle of a cannabis plant, starting from the cultivation phase where seeds are planted and nurtured. It allows for the monitoring of essential data points such as the strain of the plant, cultivation conditions, and any adjustments made throughout the process.

Meticulous Plant Tracking

By tracking the movement of the cannabis plants, from cultivation to harvest, GrowerIQ’s software ensures that all stages are documented accurately. This meticulous tracking includes information about the use of pesticides, fertilizers, and other inputs used during cultivation, providing a comprehensive record of the plant’s growth.

Manufacturing Oversight

The software enables business owners to track the processing and manufacturing of cannabis products. This includes tracking the extraction process for oils and concentrates, as well as the manufacturing of edibles, topicals, and other derivative products. By having detailed information about the manufacturing process, business owners can ensure that all products meet regulatory standards and are safe for consumption.

Comprehensive Reporting for Compliance

The full reporting capabilities of GrowerIQ’s software are invaluable in preventing compliance issues. Business owners can generate reports that capture all relevant data, such as the history of each plant, inventory levels, and sales transactions. These reports provide a transparent and auditable record of every step in the seed to sale process, making it easier to demonstrate compliance to regulatory authorities.

GrowerIQ’s seed to sale software is an essential tool for cannabis business owners looking to maintain compliance. By tracking the movement of cannabis with meticulous detail and providing full reporting capabilities, the software ensures that no compliance issues arise. With this software, cannabis business owners can confidently navigate the highly regulated landscape and focus on growing their business.

4 Seed to Sale Funding Providers

1. Seed to Sale Funding: Providing Capital for Cannabis Businesses

Seed to Sale Funding is a leading provider of capital for cannabis businesses, with a track record of successfully funding both established entities and startups in the industry. Since 2019, they have placed an impressive $120,000,000 in transactions, and their influence in the cannabis market continues to grow.

Diverse Funding for Every Stage

With a focus on the entire cannabis supply chain, Seed to Sale Funding supports projects in various sectors, including cultivation, dispensaries/retail, processing, and testing laboratories. This comprehensive approach allows them to cater to the diverse needs of the cannabis industry, ensuring that businesses have access to the capital they require to thrive.

Cannabis Industry Expertise

The team at Seed to Sale Funding understands the unique challenges and opportunities within the cannabis industry. By specializing in this emerging market, they have developed a deep understanding of the intricacies involved in cannabis business operations. This expertise enables them to provide valuable insights and guidance to their clients, helping them to maximize their success.

2. Hyde Advisory: Expert Insights and M&A Facilitation in the Cannabis Industry

Hyde Advisory is a trusted name in the cannabis industry, offering expert insights and guidance to parties with licensed cannabis businesses. With over 8 years of experience in the regulated cannabis sector, Hyde Advisory has built an unrivaled network and gained deep industry knowledge.

Expertise in Facilitating Deals

One of Hyde Advisory’s core services is facilitating mergers and acquisitions (M&A) within the cannabis industry. They have successfully facilitated numerous M&A deals, with a total value of up to $38 million. Their extensive network and industry expertise allow them to identify potential partners and investment opportunities for their clients, ensuring that they can navigate the complex landscape of the cannabis market.

Strategic Partnerships in Cannabis

Whether it’s investment, joint ventures, or divestiture, Hyde Advisory represents parties seeking opportunities in cultivation, processing, testing/research labs, retail stores, and even late-stage license applicants with built-out facilities. Their comprehensive understanding of the cannabis industry, combined with their vast network, positions them as a valuable partner for cannabis businesses looking to expand or secure investments.

3. Panther Group: Guiding Cannabis Companies Through Financial Landscapes

The Panther Group is a leading advisory firm that specializes in helping cannabis companies navigate the complex financial landscapes of the industry. With a focus on equity and debt sourcing, mergers and acquisitions, and strategic advisory services, they are at the forefront of assisting cannabis businesses in securing the financial backing they need to succeed.

Cannabis Industry Titans

Working with notable companies such as Planta Pharmaceutical, Kiva Confections, and Toast, The Panther Group has established itself as a trusted partner in the cannabis industry. They also provide strategic advisory services to companies like Fyllo and hhharvest.co, offering valuable insights and guidance for their growth and success.

The Panther Group’s expertise in the cannabis industry allows them to understand the unique challenges and opportunities that businesses face. By leveraging their deep understanding of financial markets and their extensive network, they provide cannabis companies with the support and guidance they need to thrive in a rapidly evolving industry.

4. BMO Cannabis & Emerging Industries Group: Delivering Solutions for Cannabis Businesses

BMO Cannabis & Emerging Industries Group is a specialized team within BMO Bank of Montreal that focuses on providing financial solutions for cannabis businesses. With a dedicated team of market professionals, they closely monitor the fast-moving landscape of the cannabis industry to deliver tailored solutions for their clients.

Financial Growth Strategies

BMO Cannabis & Emerging Industries Group offers a range of services, including maximizing cash flow and securing funds for growth. They work closely with BMO Capital Markets, allowing them to facilitate introductions to expert groups that can assist with strategic acquisitions and partnerships, including alliances with consumer packaged goods companies.

Industry Expertise Unleashed

With a deep understanding of the unique challenges and opportunities within the cannabis industry, BMO Cannabis & Emerging Industries Group is well-positioned to support cannabis businesses in realizing their growth potential. Whether it’s cultivation, extraction, retail, or consumer packaged goods, they have the expertise and resources to deliver the financial solutions needed in this nascent industry.

Related Reading

- Cannabis Inventory Software

- Cannabis Cultivation Software

- Cannabis Distribution Software

- Cannabis Growing Consultants

- Commercial Cultivation Business Plan

- Cannabis Angel Investors

How Seed to Sale Software Streamlines Seed to Sale Funding

Efficiently managing a cannabis business requires meticulous attention to detail and compliance with strict regulations. This is where seed to sale software comes into play, offering a comprehensive platform that streamlines and uncomplicates cannabis business operations. By automating various processes and providing real-time data insights, seed to sale software allows management to focus on more critical aspects of the business, such as increasing top-line revenue and reducing expenses.

Compliance Simplified

Seed to sale software simplifies compliance by ensuring that every step of the cannabis business, from cultivation to manufacturing to distribution, adheres to local and national regulations. This eliminates the need for manual record-keeping and reduces the risk of compliance violations. The software tracks the movement of cannabis products throughout the supply chain, maintaining accurate records of sales, purchases, and inventory levels.

Cultivation Mastery

Seed to sale software facilitates efficient cultivation management by providing a centralized platform for monitoring and controlling the cultivation process. It allows growers to track plant growth, environmental conditions, nutrient levels, and other critical factors in real-time. With automated alerts and notifications, growers can proactively address any issues that may arise, ensuring optimal plant health and maximizing yields.

Precision in Production

Manufacturing processes also benefit from seed to sale software, as it provides a comprehensive solution for managing the production of cannabis-infused products. From recipe formulation to batch tracking and quality control, the software ensures consistency, accuracy, and compliance throughout the manufacturing process. This not only improves operational efficiency but also enhances product quality and customer satisfaction.

Ensuring Quality and Safety

In addition, seed to sale software includes a robust Quality Management System (QMS) that helps cannabis operators maintain the highest standards of quality and safety. It enables businesses to track and manage quality control processes, conduct inspections, and implement corrective actions seamlessly. By streamlining these essential tasks, the software minimizes the risk of product recalls, which can be costly and damage a company’s reputation.

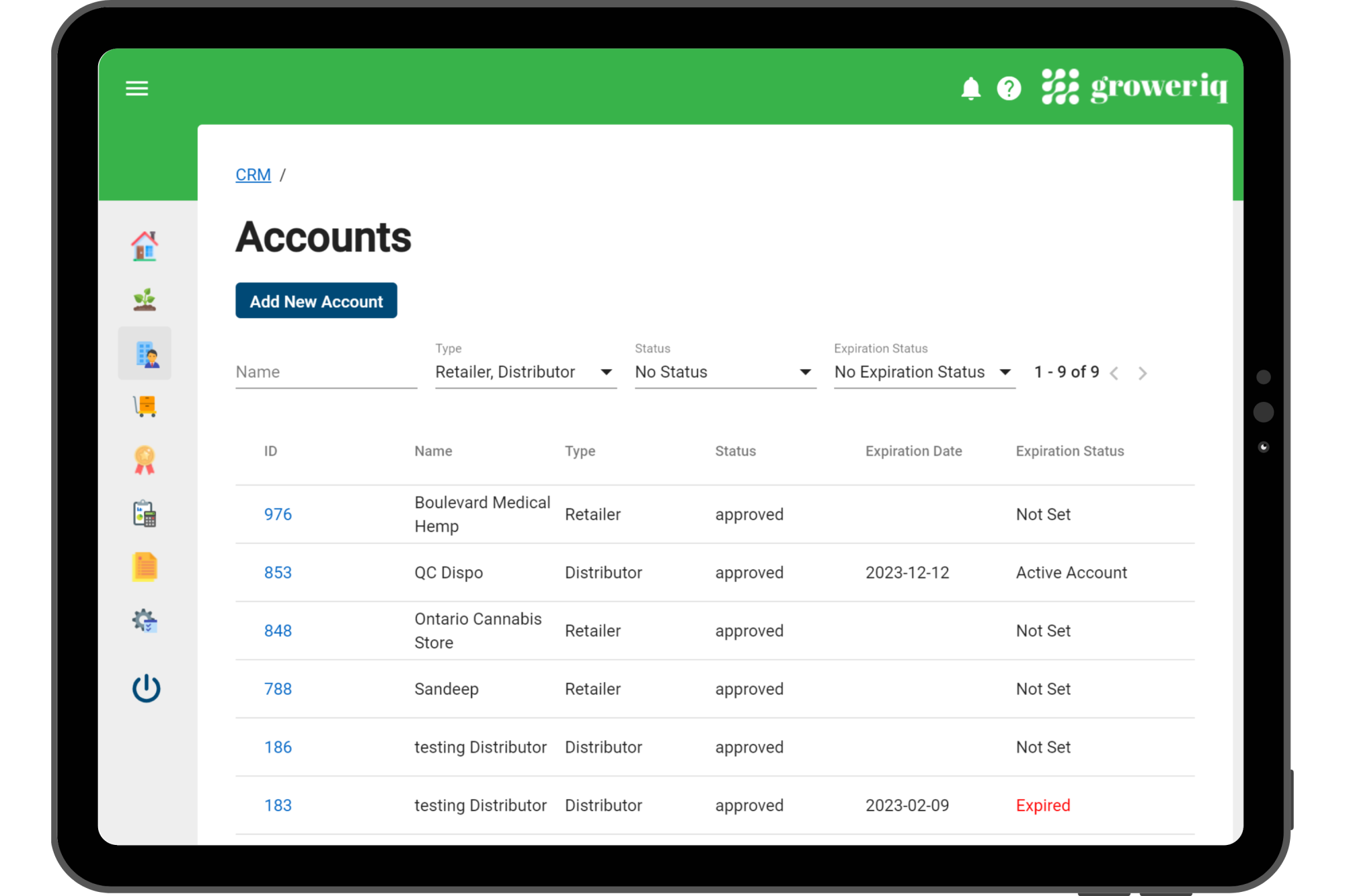

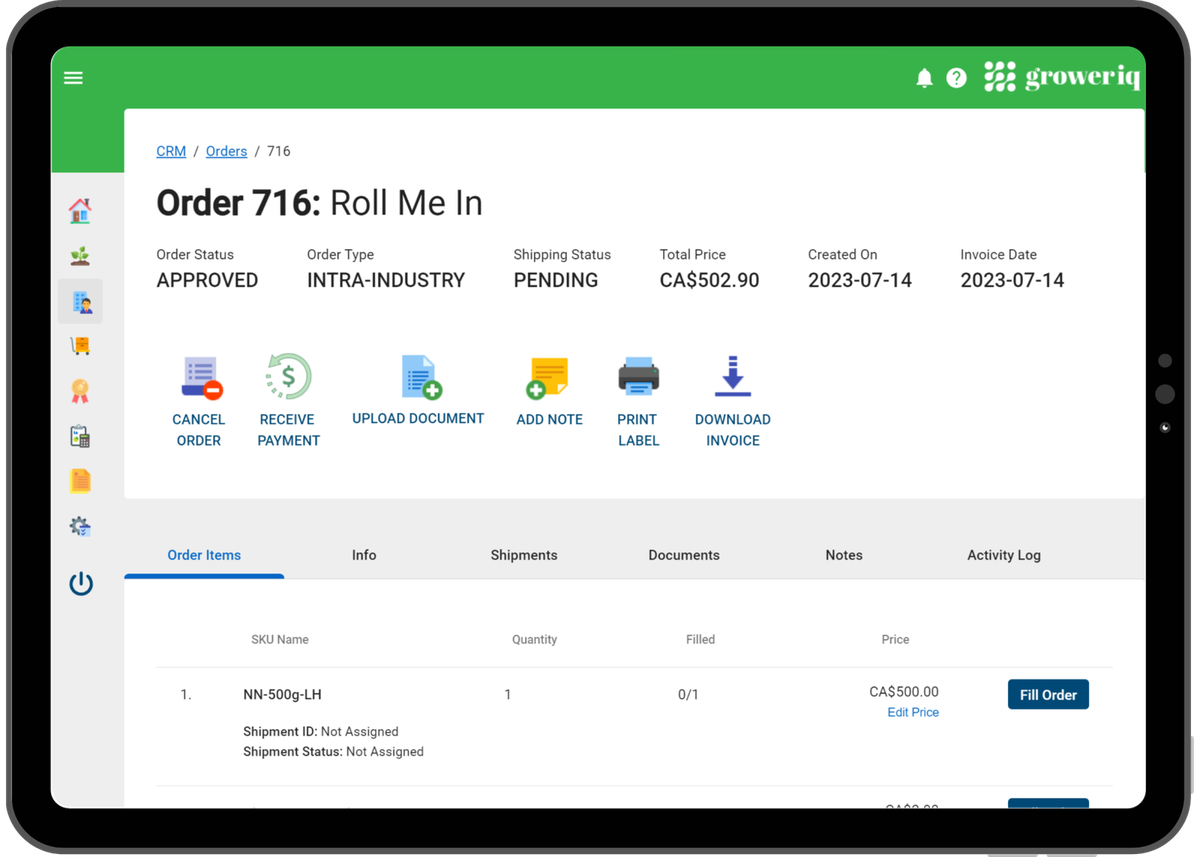

Customer-Centric Operations

Seed to sale software incorporates a Customer Relationship Management (CRM) module, allowing businesses to effectively manage their customer relationships. From capturing and organizing customer information to tracking sales and marketing activities, the CRM module helps cannabis operators understand their customers better and tailor their offerings to meet their needs. This leads to improved customer satisfaction, retention, and ultimately, increased revenue.

Comprehensive Seed to Sale Software Solution

GrowerIQ‘s comprehensive seed to sale software is designed for cannabis operators globally. Our platform offers a comprehensive suite of tools that encompass compliance, cultivation, manufacturing, quality management, and CRM. With our user-friendly interface and robust features, GrowerIQ empowers cannabis businesses to streamline their operations, maintain compliance, and focus on strategic growth initiatives. By harnessing the power of GrowerIQ’s seed to sale software, cannabis operators can unlock their full potential and drive success in an ever-evolving industry.

Discover how GrowerIQ’s seed-to-sale software can help you set up all of the administrative components of a successful cannabis cultivation operation, without any hassle. Questions we haven’t covered? Please reach out and let us know. GrowerIQ serves clients coast to coast, and we’re ready to help your team today.

Streamline Cannabis CultivationAbout GrowerIQ

GrowerIQ is changing the way producers use software - transforming a regulatory requirement into a robust platform to learn, analyze, and improve performance.

To find out more about GrowerIQ and how we can help, fill out the form to the right, start a chat, or contact us.